apart from that Employer A's cafeteria plan lets employees to revoke their elections for dependent treatment help at any time over the program 12 months and get the unused volume of dependent care help as cash. The cafeteria approach fails to satisfy the requirements During this paragraph (a), and isn't a cafeteria program.

These Gains might help offset the Original plan set up rate and perhaps assistance the business to avoid wasting considerably in the long term.

Area 137(a) presents an employee using an exclusion from gross cash flow for amounts paid or charges incurred with the employer for experienced adoption fees in connection with an worker's adoption of a toddler, When the quantities are paid out or incurred via an adoption aid program.

) from an insurance company) indicating the day from the section 213(d) medical treatment and the worker's duty for payment for that medical treatment (that is definitely, coinsurance payments and amounts underneath the strategy's deductible), and the employee certifies that any expenditure compensated from the health FSA has not been reimbursed Which the worker will not request reimbursement from any other strategy covering health Added benefits, the declare is fully substantiated with no have to have for submission of a receipt by the worker or further overview. (B) Case in point

The advantages provided from the plan will rely on your employer’s participant arrangement but usually contain:

The $769 is excludible from Employee B's gross money less than segment 106. The cafeteria plan's conditions and functions don't violate the prohibition from deferring payment. (p) Rewards regarding more than one 12 months

If the requirements of area 106 are contented, employer-provided accident and wellness coverage for an personnel and his or her wife or husband or dependents is excludible from the worker's gross profits. The reasonable marketplace value of protection for almost every other particular person, offered with respect to the employee, is includible in the worker's gross money.

The full-blown approach can be a buyer-pushed Health care (CDHC) prepare. It includes a credit procedure that the employee can use on the discretionary basis for capable costs. Employees can then health supplement the CDHC with their particular income and use it to acquire supplemental Positive aspects or coverage.

Irrespective of whether, in step with area 125 of The interior Income Code, multiple businesses (other than associates of a managed team explained in part one hundred twenty five(g)(four)) may possibly sponsor an individual cafeteria program; 2. Whether wage reduction contributions may very well be dependant on employees' strategies And just how that will do the job; 3. For cafeteria options adopting the alter in standing principles in § 1.125-four, any time a participant includes a modify in status and improvements their income reduction volume, how ought to the participant's uniform coverage total be computed once the modify in status. All responses will likely be obtainable for general public inspection and copying. A public Listening to has been scheduled for November fifteen, 2007, commencing at 10 a.m. in the Auditorium, Internal Revenue Support, 1111 Constitution Avenue, NW., Washington, DC. Resulting from developing stability techniques, site visitors ought to enter for the Constitution Avenue entrance. In addition, all readers need to present Photograph identification to enter the setting up. As a consequence of obtain limits, people will not be admitted past the fast entrance region over 30 minutes ahead of the Listening to starts off. For information regarding possessing your name put on the building accessibility checklist to go to the hearing, see the FOR More INFORMATION Call section of this preamble. The rules of 26 CFR 601.601(a)(three) implement to your Listening to. Persons who need to current oral responses at the hearing need to post written or Digital comments and an define of your matters for being talked about along with the length of time to be devoted to Each and every topic (a signed unique and eight (8) copies) by October twenty five, 2007. A duration of ten minutes are going to be allotted to Everyone for creating comments. An agenda demonstrating the scheduling on the speakers is going to be ready following the deadline for obtaining outlines has passed. Copies on the agenda will be readily available cost-free in the hearing. Drafting Information The principal creator of these proposed laws is Mireille T. Khoury, Place of work of Division Counsel/Affiliate Chief Counsel (Tax Exempt and Governing administration Entities), Inner Revenue Company. However, personnel from other workplaces from the IRS and Treasury Department participated inside their improvement. Listing of Topics in 26 CFR Section 1 Profits taxes

This provision ought to apply uniformly to all members during the cafeteria system. (A) Cash outside of unused elective paid out time without work

A grace time period is obtainable for all experienced Advantages explained in paragraph (a)(3) of this part, except the grace period won't utilize to paid day without work and elective contributions under a piece 401(k) strategy. The influence of the grace time period is usually that the employee could possibly have so long as 14 months and fifteen times (which is, the twelve months in The existing cafeteria prepare 12 months additionally the grace interval) to work with the advantages or contributions for just a approach yr prior to People amounts are forfeited

This table of contents is a navigational Software, processed through the headings in the authorized textual content of Federal Sign-up paperwork. This repetition of headings to variety inside navigation back links has check here no substantive legal influence. Company:

If, even so, the period of coverage less than a collision and overall health strategy made available through a cafeteria plan is twelve months as well as cafeteria approach does not allow an personnel to elect specific quantities of coverage, reimbursement, or income reduction for less than twelve months, the cafeteria system won't work to permit individuals to purchase protection just for periods throughout which healthcare treatment might be incurred. See § 1.a hundred twenty five-four and paragraph (a) in § 1.125-2 concerning the revocation of elections throughout a duration of coverage on account of variations in spouse and children standing. (g) FSA administrative techniques—

Added benefits not included in a piece one hundred twenty five cafeteria strategy generally never decrease the tax legal responsibility for workers or companies. In its place, tax these deductions for each the IRS Guidelines for the specific form of gain you give.

Judd Nelson Then & Now!

Judd Nelson Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Pauley Perrette Then & Now!

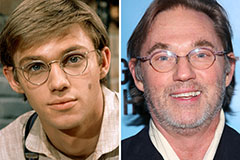

Pauley Perrette Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!